Building your dream home from the ground up is a fantastic endeavor. It lets you customize every detail to your needs and create a home that aligns with your lifestyle. However, first-time homeowners can find the home construction process overwhelming. To simplify everything, here’s a step-by-step guide to help you understand and execute the entire process.

Research Builders

Behind every successful construction there’s a qualified builder. Research a builder with vast experience, a good reputation, and a track record of completing new homes promptly and within budget. Ask for leads from your friends, co-workers, and neighbors. You can research online, too.

Select a Lot and Floor Plan

Select a Lot and Floor Plan

After settling on a builder:

• Opt for a lot and floor plan.

• Consider the size, location, and amenities within the neighborhood.

• Choose a lot that offers the desired accessibility and privacy.

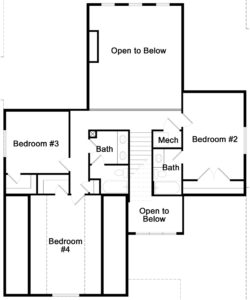

Similarly, select a floor plan that suits your goals. Most builders provide pre-designed plans with room for custom home construction. Discuss the details with them to ensure they meet your requirements.

Customization and Upgrades

Customization and Upgrades

Home customization is the exciting part of building a house from scratch. While you may want to ensure everything reflects your needs, be budget-conscious and only concentrate on upgrades that impact your everyday life and property value.

Financing Your Build

Financing Your Build

Traditionally, securing a construction loan has been the primary means to finance a building venture, transitioning into a standard mortgage upon project completion. However, contemporary practices, like those of Liberty Homes, have shifted away from necessitating construction loans. Instead, prospective homeowners are encouraged to pursue pre-approval for a mortgage, which can be locked in closer to the closing date, typically around 30 days prior. This allows for flexibility, enabling lenders to secure rates earlier for an added fee or wait for more favorable interest rates, though such intricate details may not require extensive elaboration.

This strategic move can significantly streamline the closing process. Collaborating with a preferred lender, acquainted with the homebuilder’s procedures, often results in smoother and punctual closings. Moreover, incentives or benefits, whether from the lender or the homebuilder, frequently accompany this partnership, enhancing its appeal to prospective homeowners. Access our list of preferred lenders to explore this advantageous option further.

Permits and Approvals

Permits and Approvals

Before new home construction, the builder needs to get the relevant approvals and permits from local authorities. The process can take a while, so be patient. While your builder can handle the paperwork, you should track the progress and delays.

Construction Begins

Construction Begins

After obtaining the permits, the construction can start. It’s time to visualize your dream home unfolding into reality. Talk with your builder regularly to understand the progress, and address emerging concerns or questions promptly.

Home Inspections

Throughout the building process, the homebuilder will arrange various inspections to ensure everything meets local building codes and quality standards. Typically, inspections cover the overall structure, plumbing, foundation, and electrical systems. Once construction is complete, the builder will schedule a final home inspection needed to obtain the Certificate of Occupancy before you can close or move in.

Final Walkthrough

Before you close and move in, you need a final walkthrough with the constructor. This moment helps you identify possible flaws that require attention. All items identified at the final walkthrough will be noted on the punch list that will be signed by the builder’s representative and you as a record of what work is to be done prior to moving in.

Closing and Move-In

After completing the walkthrough and making the necessary fixes, it’s time to close on your dream home. The process entails signing relevant documentation. Once closing is done and your mortgage has funded, get the keys to your new home and move in.

Homeownership Responsibilities

Congratulations on being the new homeowner in town! This new title has several responsibilities, such as paying property taxes, maintaining the property, and following homeowners’ association guidelines. Learn more about these obligations and be ready to fulfill them.

Enjoy Your New Home

After building a new home, you can sip coffee on the couch, throw a party, or decorate your space. Moving into a new home should be an enjoyable time to create life-long memories with your family.

With the above home construction guide, first-time homebuyers can start the journey and build a home that suits their preferences.

Contact us to get more information on constructing your first home.